Problems

After starting to promote Token.io platform to the target audience, the client came across the following issues:

- Complicated lead research. Fintech has always been a rather complicated industry. When it came to finding prospects willing to engage in open banking and explore new digital opportunities, the client required directions and platforms to obtain valuable public data. Doing that research without assistance looked like a time-consuming task.

- Lack of experience with cold outreach. The client had a good online presence, creating Token.io accounts in Facebook, LinkedIn, Instagram, etc. However, writing cold emails was something Token.io has never dealt with before. Therefore, the client needed an experienced team familiar with writing emails and building campaigns.

- Missing out on big corporations.

While having large companies as customers would greatly benefit Token.io, the client needed assistance with crafting a compelling message and finding the right titles. In order not to miss an opportunity to enrich the lead database, Token.io needed to find and explore new ways of connecting with the right professionals at the right moment.

What we did

1. Going the extra mile

Knowing the key pain points the client was dealing with, we started addressing them step by step. First things first, we needed to introduce Token.io to big companies. However, the issue with innovative digital products/services is that they’re hard to explain in a single sentence. Our goal was to connect with people who would understand the multitude of peculiarities and special features of the Token.io product and then communicate them to a decision-making group. To accomplish this, we had to take the following steps.

- Research the client’s product.

Exploring the client’s product or service's purpose and specifics is a natural stage of any project we’re working on. Our sales team reached out to the experts of Token.io and requested all marketing materials available in order to understand what they were going to sell and how they were going to do it. We researched the entire range, from presentations to previous sales pitches in order to learn more about the brand voice and how potential buyers perceive it.

We targeted businesses in the United Kingdom, Ireland, Switzerland, France, Germany, Estonia, Latvia, Italy, Luxembourg, Belgium, and other countries, focusing on the industries that could benefit from enhanced digital transactions but required some guidance from experienced professionals (Oil and Energy, Utilities, Cryptocurrency and Renewables, etc).

- Granular research.

After exploring the product, we started our lead research. Since there weren’t many businesses that checked all the boxes, we used a granular approach, digging into multiple databases and gleaning the most relevant financial industry leads. We kept in touch with the client, regularly addressing the base and doing double qualification with both our and client’s SDRs.

2. Picking up the speed

- Asking for referrals.

To make sure that our project is dynamic, we used referral templates for more precision and asked potential decision-makers directly whether they were qualified to discuss the product of Token.io. In case we were reaching out to the wrong person, we asked for directions.

- Template crafting.

After building a solid list of leads, we worked on developing a captivating message. The purpose of our email campaign was to both introduce the client’s prospects to the concept of open banking (in case they haven’t explored it before) and outline its benefits. We also made sure to provide facts and numbers, explaining why PISPs are no longer a novelty, but a solid way of making safe transactions.

- Building an outbound channel.

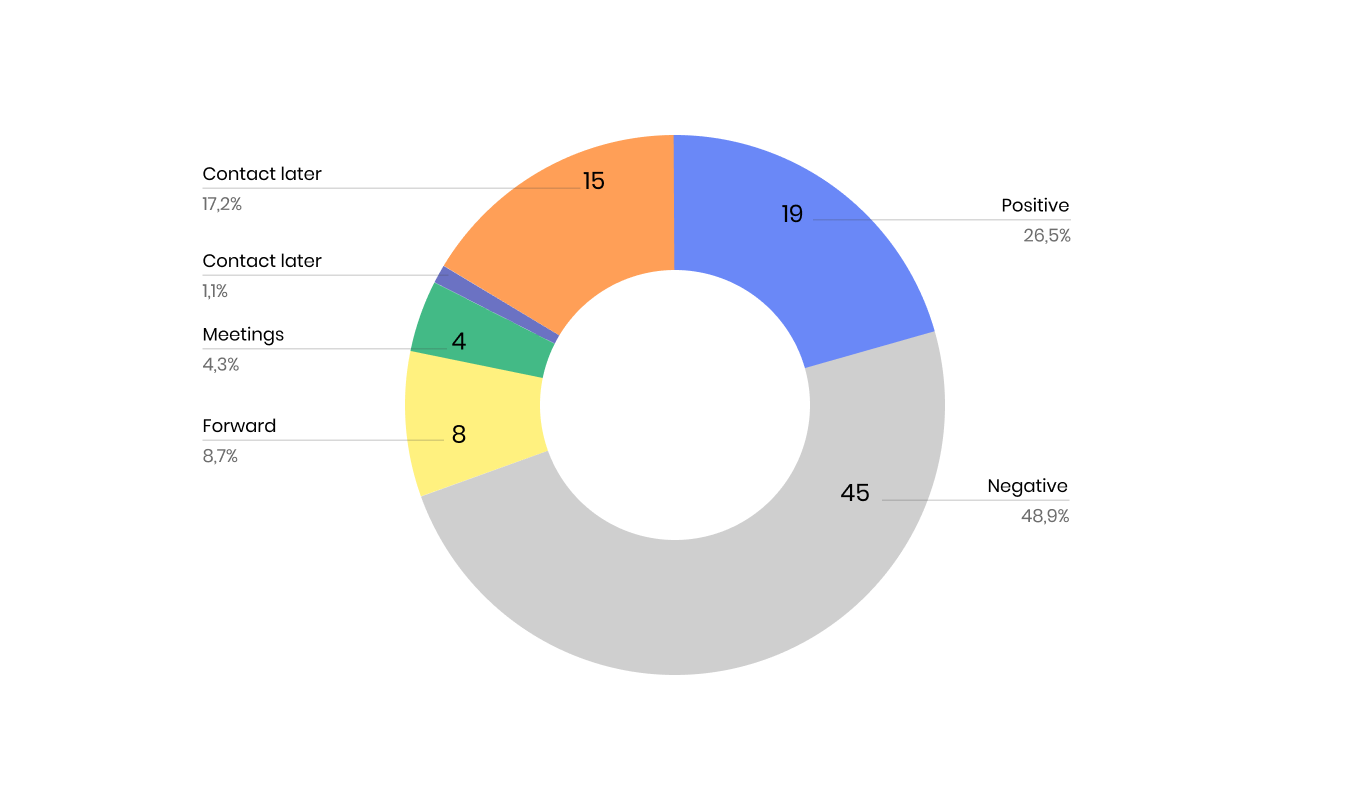

After making templates, we launched our campaigns and started nurturing prospects so that they booked a call with the SDRs of Token.io. After receiving a positive response from a prospect, we booked a time slot and handed the prospect over to the client’s sales representative together with all the templates and materials we used.